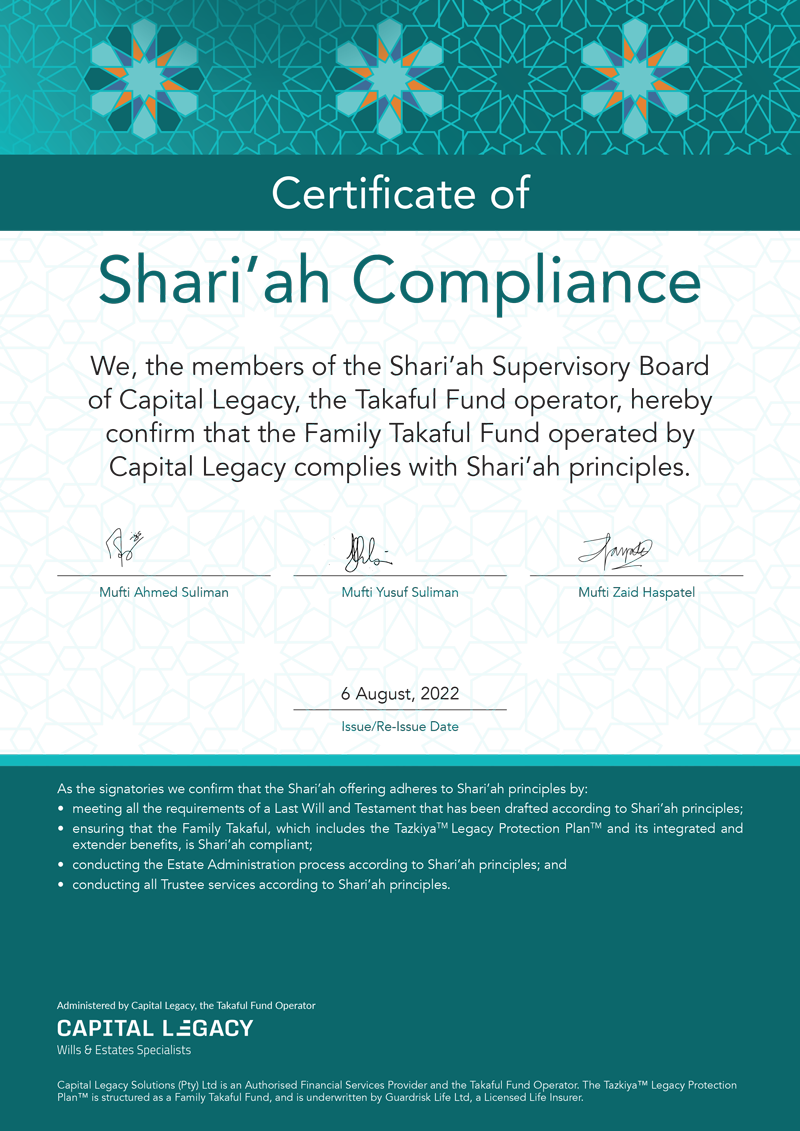

THE TAZKIYA™ SUPERVISORY BOARD MEMBERS

The Supervisory Board is independent of Tazkiya™ and its role is to ensure that the products and services of the Tazkiya™ offering are and remain compliant in terms of the principles of Islamic Law.

MUFTI AHMED

SULIMAN

Ahmed is a Shari’ah Scholar of very high repute and has served as a Shari’ah Advisor for, and as a Board Member on, various financial institutions for the past 17 years, both inside and outside South Africa.

He completed a BA/MA Alim course (Higher Islamic Studies) and thereafter completed the Ifta course (Islamic Jurisprudence and issuance of Fatwa [Islamic verdicts]), at Darul Uloom Zakariyya.

For three years, he served as a Mufti for the Jamiatul Ulama KZN (Council for Muslim theologians) where he looked after the Fatwa and Judicial Departments and was a member of the Mediation and Arbitration committee. On behalf of Jamiatul Ulama KZN, he served as a member on the Board of Muftis of South Africa.

MUFTI YUSUF

SULIMAN

Yusuf is the head of Shari’ah for Standard Bank and serves on the Shari’ah Boards of the Bank of Maldives, Takaful Africa, GIC Re-Takaful, Alexander Forbes, Element Investment Managers and Shari’ah Investments Ltd (Malawi). He is also a consultant to Investec Bank and FNB Securities. He is one of only a few Scholars in SA who is accredited by AAOIFI as a Shari’ah Advisor and Auditor.

He was contracted by BankSETA to develop the Islamic Banking training material for all Islamic South African Banks.

He holds Certificates in Qadha (adjudication) from Imarat Sharia’h, Patna Bihar (India), and has completed the Ifta course (Islamic Jurisprudence and issuance of Fatwa [Islamic verdicts]), at Darul Uloom Zakariyya.

MUFTI ZAID

HASPATEL

Zaid completed a BA/MA Alim course and thereafter completed the Ifta course (Islamic jurisprudence and issuance of Fatwa [Islamic verdicts]), at Darul Uloom Zakariyya.

He currently lectures at Darul Uloom Zakariyya and is actively involved in the field of Ifta with a special focus on Islamic finance.

He also serves as a Shari’ah Advisor to various Islamic Financial Institutions, including FNB, Standard Bank, Investec Bank, 27Four Investment managers, and Sentio Capital.

THE TAZKIYA™ TRUSTEES

The Shari’ah Trustees operate the Tazkiya™ Waqf (Trust) which holds and oversees the Tazkiya™ Takaful Fund.

MUFTI SHAFIQUE AHMED JAKHURA

Shafique serves in the Fatwa Department at the Darul Ihsan Research Centre, in Durban, preparing and issuing Islamic juristic rulings. He has established and is head of the Centre for Islamic Economics and Finance SA (CIEFSA) which is a non-profit organisation dedicated to increasing awareness and providing education in the fields of Islamic economics and finance, structuring Shari’ah-compliant transactions and providing Shari’ah-compliant commercial solutions at various levels.

In 2002, he completed the Aalimiyah Course at Madrasah Taleemuddeen in Durban, with distinction. In 2005, he completed a three-year specialisation course in Islamic Jurisprudence (Fiqh and Fatwa) at Jamia Darul Uloom Karachi, under the guidance of Mufti Taqi Usmani, which culminated in the submission of a thesis on the topic of Shirkat and Mudharabat.

He is certified as a Shari’ah Accountant and Auditor by the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI), in Bahrain. He has an Advanced Diploma in Islamic Banking and Finance from the Karachi-based Centre for Islamic Economics.

MUFTI MOHAMMED VALLI

Mohammed is an academic and lecturer in Islamic jurisprudence at the Jami’ah-al-Uloom-al-Islamiyyah, in South Africa. He is currently employed as a consultant and advisor to a few financial institutions, in the field of Islamic Banking and Finance. He has experience in the accounting, auditing and governance of Islamic financial institutions and is acutely aware of the contexts, opportunities and limitations that characterise the Islamic Finance industry.

Mohammed graduated cum laude with a Masters in Islamic Finance (MSc) from The Global University for Islamic Finance (INCEIF), in Malaysia. Prior to that, he completed both his Aalim Fa’dhil and Ifta courses at Darul Uloom Zakariyya, in Johannesburg. He also holds degrees in Islamic Studies and Accounting Sciences from the University of South Africa (UNISA).

THE TAZKIYA™ CONSULTANTS

IGSHAAN SAMSODIEN

BCom - Finance, Investments and Information Systems

International Peace College of South Africa (IPSA) Islamic Studies

- My Islamic studies have ensured that I have a solid foundation in what is prescribed by the Qur’an and how the product and services provided through the Tazkiya™ offering can meet the unique needs of the Muslims, within South Africa.

NADIR FORTUNE

Business Management SLP Certificate

BCom Business Management Degree with Varsity College - completing final year

- For eleven years, prior to starting at Capital Legacy, the Takaful Fund Operator, I have practised and honed my skills in customer service, recognising the importance of considering each individual’s unique needs and striving for service excellence as I meet each need with an appropriate solution. Being part of the Takaful Fund Operator, allows me to provide a unique service to the Muslims within South Africa, meeting each one’s unique needs when it comes to doing their estate planning and providing certainty for their loved ones.

MUSTAFA ABDULLAH ALLIE

BCom - Finance (UWC)

- With nearly a decade of experience in the Financial Services Industry and a comprehensive background in insurance and investments, I have developed a passion for providing sound financial advice and finding creative/cost effective solutions for complex problems that Clients are facing.

The launch of the Tazkiya™ Legacy Protection Plan™ offers so many new possibilities and a unique way to fulfill your Islamic obligations, ensuring you leave the best legacy possible for your Family. I’m so proud to be a part of the professional consulting force bringing the Tazkiya™ Legacy Protection Plan™ to our Muslim communities, which is a first for the South African market.

MOHAMMED DOCKRAT

Regent Business School: Certificate focused on Islamic Law and Finance

NQF5

Currently doing a Diploma in Islamic Finance through CIMA

- I have gained years of experience as a Sales Consultant within the Banking and Financial Industry and with the launch of Tazkiya™ I can confidently say that I can now help so many Muslims gain financial security while at the same time honouring the Islam faith and following the guidelines set out in the Qur’an. Drafting a Will through Tazkiya™ allows you to put into action what the Prophet Muhammed (peace be upon him) said, and it helps you provide certainty for your loved ones. They know that what you leave to them will be given to them according to what is set out in the Qur’an and not according to the country’s laws of intestate succession.

NAEEM KHAN

BCom Management

National Certificate: Wealth Management

RE1 and RE5

- I am a highly motivated professional and have gained years of experience as a Wealth Manager within the Financial Industry. With the launch of Tazkiya™, I can confidently say that I can now help so many Muslims gain financial security. Furthermore, the Tazkiya™ MyLegacy Cover™ now provides an opportunity for Muslims to effectively secure life cover using the well-known global Takaful Fund approach without compromising on their beliefs, yet still providing for their families should the inevitable happen and they pass away.