THE FIRST-OF-ITS-KIND SHARI’AH-COMPLIANT WILL, FAMILY TAKAFUL, LIFE COVER AND ESTATE ADMINISTRATION OFFERING IN SOUTH AFRICA.

COVER THE COSTS RELATED TO DEATH WITH A

SHARI’AH-COMPLIANT SOLUTION

TO LEAVE A LASTING LEGACY.

or contact your financial advisor

OR DOWNLOAD THE TAZKIYA™ BROCHURE >>

A COMPLETE SOLUTION FOR MUSLIM COMMUNITIES FROM WILL TO INDEMNIFICATION OF FEES TO ESTATE ADMINISTRATION BROUGHT TO YOU BY CAPITAL LEGACY - THE TAKAFUL FUND OPERATOR.

Learn more about Capital Legacy >>

THE TAZKIYA™ WILLS AND ESTATES PRODUCT AND SERVICES OFFERING COMPRISES FOUR ELEMENTS:

“It is prescribed upon you, when death approaches (any) one of you - if he leaves behind wealth - then he should make a will (wasiyyah) for his parents and near relatives in a fair manner (in the one-third). This is a duty upon the pious people.”(2:180)

ISLAMIC LAST WILL & TESTAMENT

THE DRAFTING OF YOUR SHARI’AH-COMPLIANT WILL AND SAFEKEEPING SERVICE, AT NO COST TO YOU, THE TAKAFUL FUND MEMBER. THIS IS PART OF THE LEGACY SERVICES™ THAT ARE AVAILABLE TO YOU

75% of South Africans pass away without a valid Will in Place & 90% don’t plan for the unexpected costs and expenses related to death and winding up an Estate.

Our mission is to have more valid Wills in South Africa that adhere to Islamic principles and lower legal fees at death for our Muslim Clients.

THE DRAFTING OF YOUR SHARI’AH-COMPLIANT WILL AND SAFEKEEPING SERVICE, AT NO COST TO YOU, THE TAKAFUL FUND MEMBER. THIS IS PART OF THE LEGACY SERVICES™ THAT ARE AVAILABLE TO YOU

75% of South Africans pass away without a valid Will in Place & 90% don’t plan for the unexpected costs and expenses related to death and winding up an Estate.

Our mission is to have more valid Wills in South Africa that adhere to Islamic principles and lower legal fees at death for our Muslim Clients.

HOW IT WORKS

The Tazkiya™ Will service provides you with the opportunity to draw up a Will according to your chosen School of Thought that adheres to Islamic principles - providing for your Islamic Heirs, religious liabilities and obligations, and any Wasiyyah you wish to make.

All elements of the Tazkiya™ Legacy Protection Plan™ – the Family Takaful and the Trust – as well as the Takaful Fund Operator, are reviewed regularly by an independent Shari’ah Supervisory Board to ensure compliance with the principles of Shari’ah. The Supervisory Board members and the Trustees are recognised as market leaders and highly experienced Islamic scholars in SA.

COVER FOR LEGAL FEES

THE TAZKIYA™ LEGACY PROTECTION PLAN™

COVER THE COSTS RELATED TO DEATH FROM AS LITTLE AS

R87.31 PER MONTH.

The unique, first-to-market Tazkiya™ Legacy Protection Plan™ is a complete Shari’ah-compliant solution that accompanies your Islamic Will, honouring your faith by providing for your Islamic Heirs and covering you and your loved ones from the inevitable legal fees associated with death.

COVER THE COSTS RELATED TO DEATH FROM AS LITTLE AS R87.31 PER MONTH.

The unique, first-to-market Tazkiya™ Legacy Protection Plan™ is a complete Shari’ah-compliant solution that accompanies your Islamic Will, honouring your faith by providing for your Islamic Heirs and covering you and your loved ones from the inevitable legal fees associated with death.

TOP 6 IMPORTANT COSTS RELATED TO DEATH

These are some of the fees your family will need to cover when you pass away.

SHARI’AH WILL AND ESTATE ADMINISTRATION SERVICES

Ensuring you leave a purified legacy starts with your Islamic Will, is guided by your Succession Plan™ and is transferred to your Islamic Heirs through the Estate Administration process.

EXECUTOR, TESTAMENTARY TRUST AND CONVEYANCE FEES

Your Islamic Estate is required to pay certain religious liabilities and fees during the Estate Administration process, to honour your faith. Often, these fees are not provided for, depleting the Heirs’ inheritance.

IMMEDIATE EXPENSES

Due to the burial rites as provided in the Qur’an, your loved ones may be left financially strained immediately after your death.

MONTHLY LIVING EXPENSES

Estates can take months, if not years, to wind up and families mistakenly assume the Estate will pay the monthly ongoing expenses such as lights, rent, groceries, etc. but the funds are often tied up until the Estate is finalised.

LIFE COVER

The traditional South African financial products do not adhere to the Islamic principles of purification, i.e. keeping your finances untainted by gambling, interest, etc.

TAXES

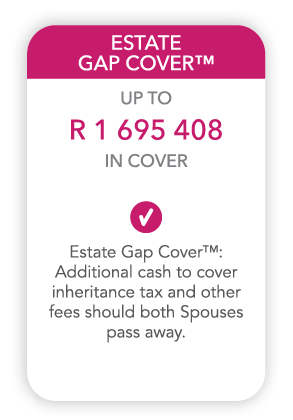

Most people leave their entire Estate to their Spouse, but if both of you pass away and your Children inherit everything then Capital Gains Tax and other inheritance taxes are triggered.

HOW IT WORKS

Until now, there has been no clear leader in Shari’ah-compliant solutions for the Muslim community in South Africa. According to Islam, conventional insurance products are forbidden as they are tainted with interest and uncertainty. As a result, South African Muslim communities have been unable to protect their families and provide financial security when they pass away in a manner that allows them to observe their faith.

Capital Legacy, the Takaful Fund Operator, has has created a Family Takaful, ensuring that the Tazkiya™ Legacy Protection Plan™ cover is completely Shari’ah-compliant and in accordance with Islamic principles as none of the funds are ‘contaminated’ by interest or any other undesired financial influences.

BENEFITS AND CONTRIBUTIONS

Secure up to 100% cover against the Executor, Trust, Conveyance Attorney and Non-estate Asset Fees.

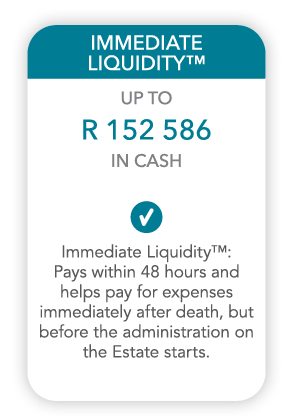

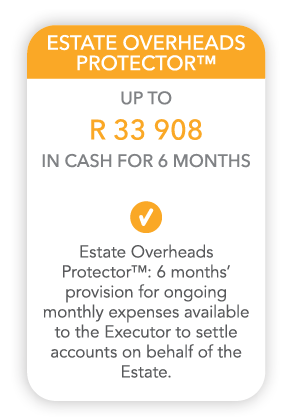

The Indemnity Plan™ you select determines the value of your Maximum Indemnity Benefit™ (MIB™), as well as your Integrated Benefits - Immediate Liquidity™, Estate Overheads Protector™ and Estate Gap Cover™. These cash benefits provide for specific expenses incurred when you pass away.

Should these benefits not adequately address the cash needs of your family, there are Extender Benefits which can be added to your selected Indemnity Plan™ to adequately meet the future needs of your family.

MAXIMUM INDEMNITY BENEFIT™

UP TO

R3 390 816

MIB™: The Maximum Indemnity Benefit™ refers to the value to which your selected Tazkiya™ Legacy Protection Plan™ covers the Executor, Trustee, Conveyance Attorney and Non-estate Asset Administration fees, which are determined by the value of your assets.

INTEGRATED BENEFITS

(automatically included in your Plan)

PLAN VALUE TO THE BENEFICIARIES

UP TO

R 5 272 718

BURIAL SOCIETY BENEFIT TO THE VALUE OF R 10 000

This Benefit will pay an additional R10 000 directly towards the Burial Society, for the burial of the deceased Plan holder, at no additional cost.

EXTENDER BENEFITS

(optional extra cover)

MYLEGACY COVER™

UP TO

R15 000 000

IN COVER

MyLegacy Cover™:

fully Shari’ah-compliant life cover. MyAbility Cover™: cover for impairment and critical illnesses.

LIFE AND DISABILITY COVER

MYLEGACY COVER™ IS AN OPTIONAL EXTENDER BENEFIT OF THE TAZKIYA™ LEGACY PROTECTION PLAN™

GET UP TO R15 MILLION LIFE COVER AND UP TO R5 MILLION COVER FOR IMPAIRMENT AND CRITICAL ILLNESS.

Optional life and disability cover that is also available via the Family Takaful so that it is Shari’ah-compliant. This may be taken as an addition to the Tazkiya™ Legacy Protection Plan™ and will provide for a variety of financial planning scenarios including the repayment of debts.

GET UP TO R15 MILLION LIFE COVER AND UP TO R5 MILLION COVER FOR IMPAIRMENT AND CRITICAL ILLNESS.

Optional life and disability cover that is also available via the Family Takaful so that it is Shari’ah compliant. This may be taken as an addition to the Tazkiya™ Legacy Protection PlanTM and will provide for a variety of financial planning scenarios including the repayment of debts.

MYLEGACY COVER™

Using MyLegacy Cover™, you can (take action during your lifetime to) provide for a stipulated beneficiary when you pass away (from Tazkiya’s Takāful Waqf Fund).

IT IS COMPARABLY CHEAPER

By doing it with your Islamic Will and Tazkiya™ Legacy Protection Plan™, we can pass the savings on to you.

IT INTEGRATES WITH YOUR ISLAMIC WILL

To ensure you make the correct beneficiary nominations.

IT’S FLEXIBLE

You can choose between having More Cover, Less Contribution or a 5-year Cash Back, as well as switching between these options at any time.

SAVE ON EXECUTOR AND TRUSTEE FEES

Life cover that pays from the family Takaful to your Estate is indemnified against Estate fees.

IT IS CONVENIENT

A quick and easy application process from start to finish.

MYABILITY COVER™

Optionally with the MyLegacy Cover™ extender Benefit, you can also take MyAbility cover™ offering cover for both impairment and critical illness.

UP TO R5 MILLION COVER

ACCELERATOR BENEFIT

The combination of impairment and critical illness means you are covered for either event.

CONVENIENT UNDERWRITING

Automations within the underwriting process result in quicker and more efficient turnaround times.

PROGRESSIVE UNDERWRITING

We will accept the decision made, within the last 3 years, by a previous insurer and provide a better or competitive rate.

BENEFACTOR™

Choose the option that best suits you and your pocket - and change whenever you want.

MORE BENEFIT

Increase your life cover amount at cost price.

LESS CONTRIBUTION

Reduce your monthly contributions without sacrificing cover.

CASH BACK

Receive up to 12 months’ contributions back in cash, every 5 years.

ESTATE ADMINISTRATION

BURDEN-FREE AND EFFICIENT SERVICE THAT ADHERES TO ISLAMIC PRINCIPLES.

Capital Legacy, the Takaful Fund Operator and largest Estate Administration provider’s service has now been fully upgraded to render services for Shari’ah Wills and Estates.

BURDEN-FREE AND EFFICIENT SERVICE THAT ADHERES TO ISLAMIC PRINCIPLES.

Capital Legacy, the Takaful Fund Operator and largest Estate Administration provider’s service has now been fully upgraded to render services for Shari’ah Wills and Estates.

THE ESTATE ADMINISTRATION AND TRUST OFFERING

PAYMENT OF BURIAL & SHROUDING EXPENSES

SETTLEMENT OF RELIGIOUS LIABILITIES & OBLIGATIONS

PAYMENTS OF ALL DEBTS

ISLAMIC HEIRS CONFIRMED BY RELEVANT MUSLIM JUDICIAL BODY

PAYMENT OF WASIYYAH (BEQUESTS) IF APPLICABLE

CREATION OF SPECIFIED TRUSTS

RESIDUE DISTRIBUTED AMONGST ISLAMIC HEIRS

FACILITATE PAYMENT OF ANY RETIREMENT ANNUITY & GROUP LIFE COVER

MONTHLY INCOME FROM WIDOWS TRUST WITH MYLEGACY COVER™ FOR SPOUSE COMMENCES

WHY CHOOSE TAZKIYA™ FOR YOUR WILL, LEGACY PROTECTION PLAN™ AND ESTATE ADMINISTRATION?

YOU CAN HONOUR YOUR FAITH

Draft a Will according to your chosen School of Thought and adhering to Islamic principles, providing for your Islamic Heirs, religious liabilities and any Wasiyyah you wish to make.

PURIFIED FINANCIAL PROVISION

All contributions that you make towards the Takaful Fund remain untainted by undesirable financial influences.

AN INDEPENDENT SHARI’AH SUPERVISORY BOARD

All aspects of the Tazkiya™ product and services are regularly reviewed by an independent Shari’ah Supervisory Board.

SHARI’AH-COMPLIANT ADMINISTRATION OF YOUR ESTATE

When your Estate is administered it will be done so according to Islamic law.